Calculating the ROI of Automation: A Practical Guide for Manufacturers

Investing in new machinery is one of the most significant financial decisions a manufacturing business can make. While new automated equipment promises higher efficiency and quality, the ultimate question for any business owner or manager is: "Is it worth the cost?" The key to answering this question with data, not just intuition, is calculating the Return on Investment (ROI).

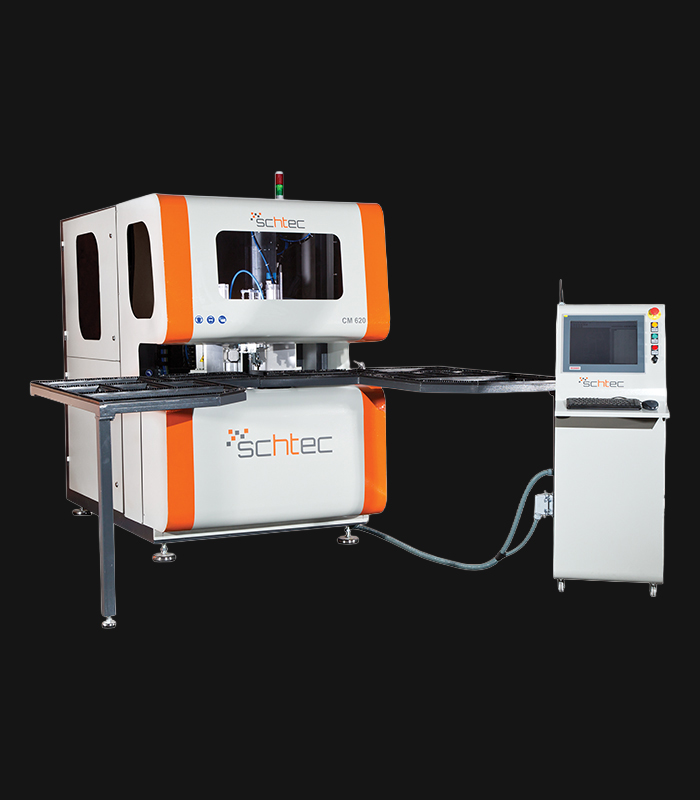

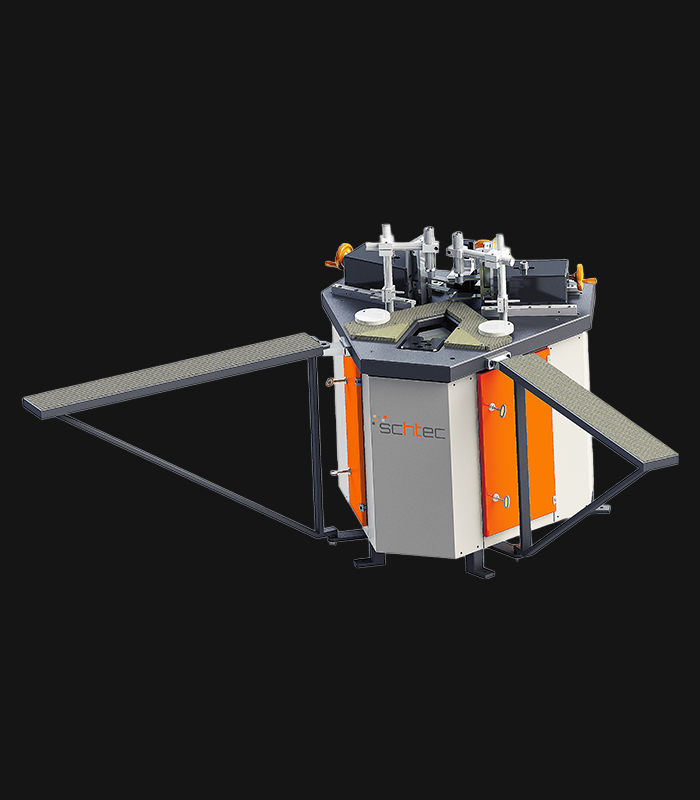

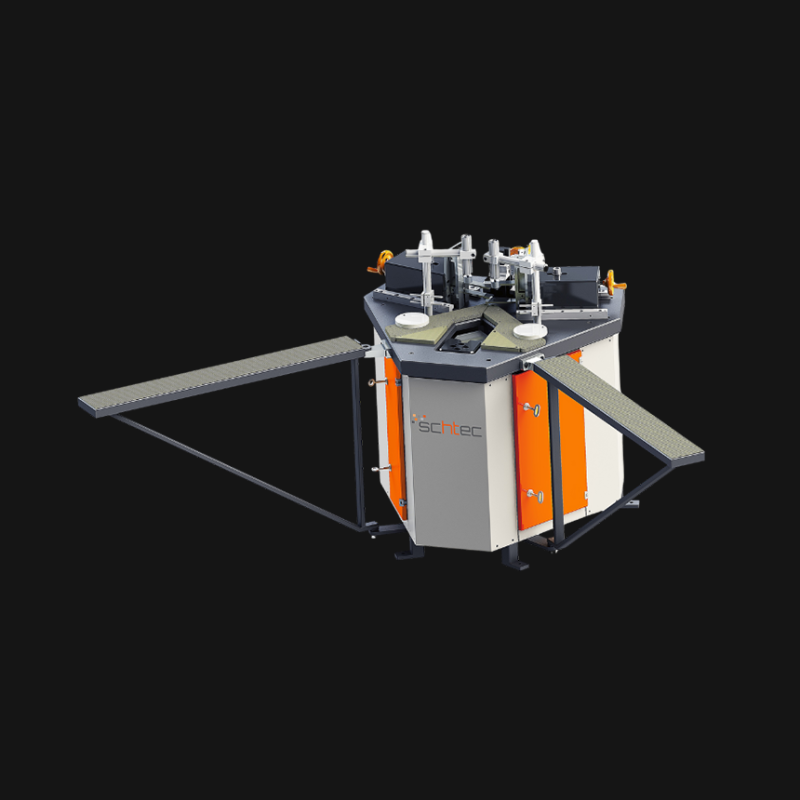

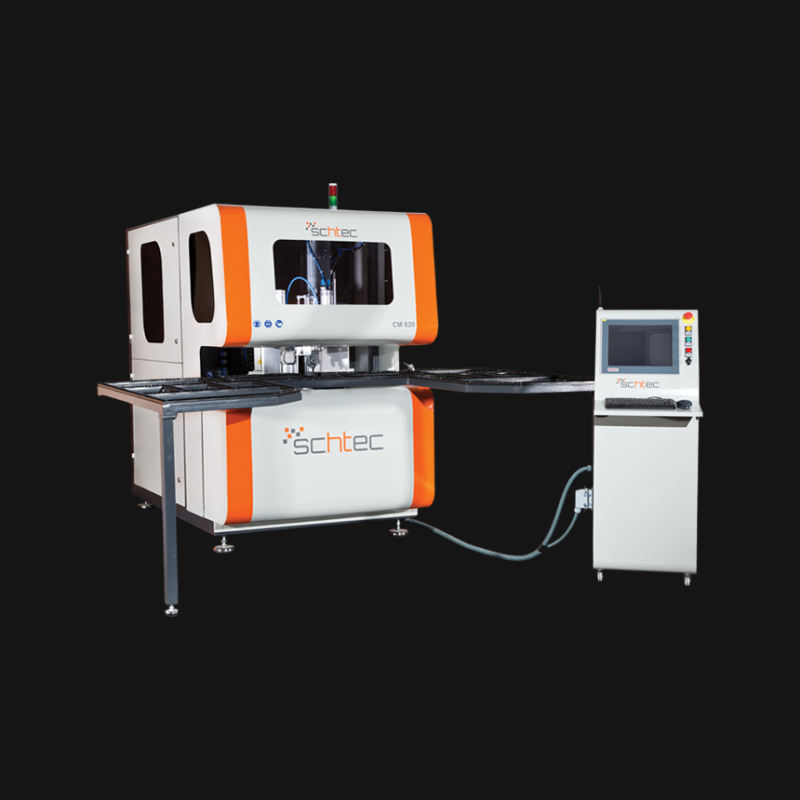

This guide will provide a practical framework to help you analyze the financial impact of automating a process like corner cleaning, transforming a major expense into a clear and profitable investment.

What is ROI and Why Does It Matter?

Return on Investment is a performance measure used to evaluate the efficiency of an investment. In simple terms, it tells you how much profit you will get for every dollar, pound, or euro you invest. A high ROI means the investment's gains compare favorably to its cost. For a manufacturing business, this calculation provides a clear financial justification for purchasing new equipment, making it an essential tool for strategic planning.

Step 1: Identifying the Full 'Investment' (The Costs)

The first step is to calculate the total cost of the investment. This goes beyond just the price tag of the machine.

Purchase Price: The initial cost of the corner cleaning machine itself.

Ancillary Costs: This includes any costs related to shipping, installation, and initial operator training.

Ongoing Operational Costs: Consider the estimated annual cost of electricity consumption, routine maintenance, and consumable parts like replacement blades.

Step 2: Quantifying the 'Return' (The Gains and Savings)

This is where the true value of automation becomes clear. The "return" is a combination of direct cost savings and new revenue generated from increased efficiency.

Gains from Reduced Material Waste: Calculate how many frames you currently scrap per month due to manual cleaning errors. Multiply this by the cost per frame to find your current monthly loss. An automated machine can reduce this number by over 95%, creating a significant and immediate monthly saving.

Gains from Increased Labor Efficiency: Automation doesn't necessarily mean replacing workers; it means optimizing their time. Calculate the labor hours currently spent on manual cleaning and rework. An automated machine frees up these valuable hours, allowing your skilled team to focus on other value-adding tasks like assembly or quality assurance.

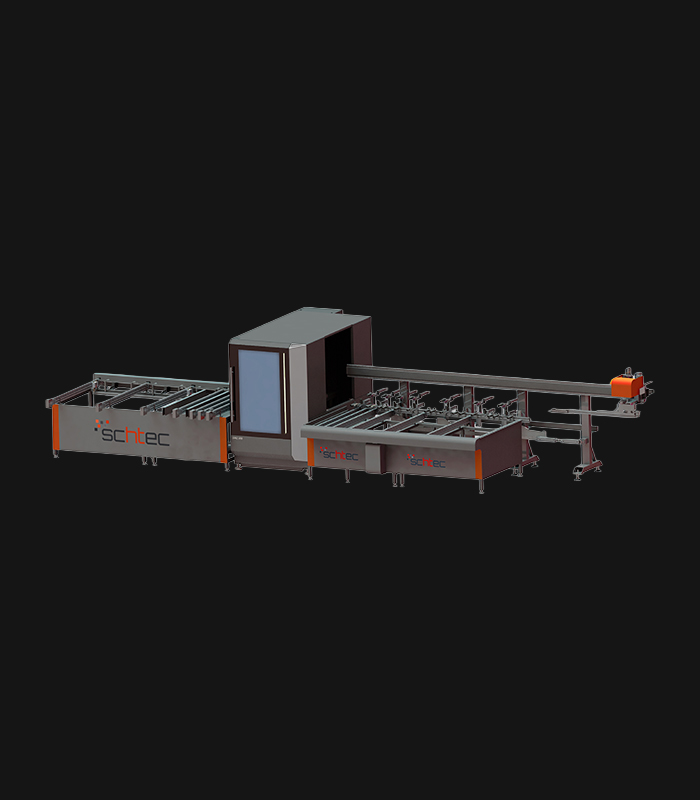

Gains from Higher Production Throughput: This is the most powerful return. If a machine allows you to produce even 15-20% more windows per day, what is the profit value of that extra production over a year? This new revenue stream is often the single largest contributor to a fast ROI.

Putting It All Together: The Payback Period

While a complex ROI percentage can be calculated, a more straightforward metric for many businesses is the Payback Period. The formula is simple:

Total Investment / Total Annual Savings & Gains = Payback Period (in years)

For example, if the total investment is €30,000 and the combined annual savings and new profit from increased throughput is €25,000, your payback period is just 1.2 years. After that point, the machine is generating pure profit for your business.

Conclusion: An Investment, Not an Expense

By systematically calculating the costs and quantifying the returns, it becomes clear that investing in automation is not an expense, but one of the most powerful financial levers a manufacturer can pull. It is a direct investment in higher quality, greater capacity, and long-term, sustainable profitability.